CRQ: The Key to Understanding and Managing Cyber Risk

Kovrr's cyber risk quantification platform enables risk managers and key decision-makers to financially quantify their cyber risk exposure and develop data-driven mitigation plans.

Make Smart Business Decisions.

Kovrr’s Cyber Risk Quantification Platform Key Features

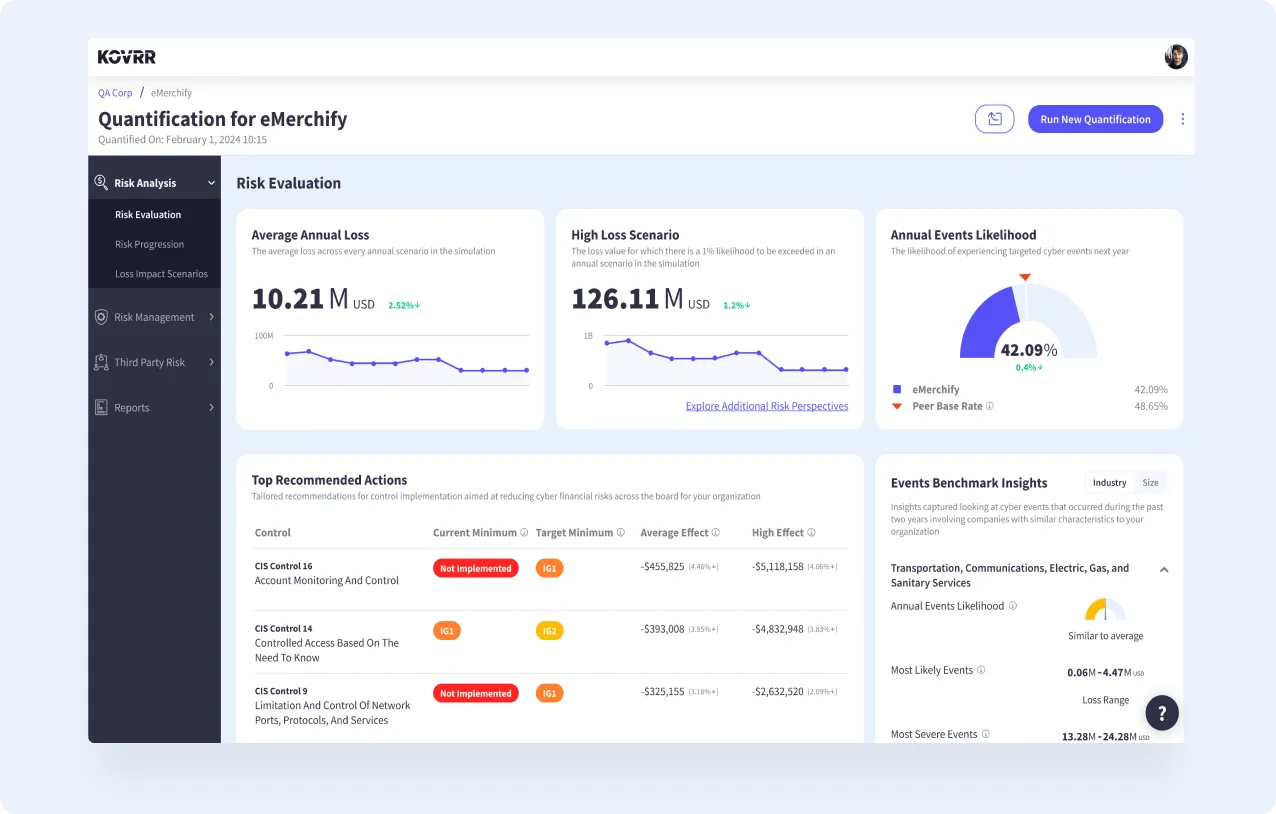

On-Demand Quantitative Cyber Risk Analysis

Evaluate and assess your enterprise’s financial exposure to cyber risk by quantifying the likelihood and impact of cyber events. Kovrr's modeling methodology uses a Monte-Carlo simulation to produce a highly accurate assessment that accounts for into account your organization's specific cybersecurity resilience, the threat landscape, and cyber insurance data.

The results are an in-depth array of financial outputs, broken down by events and various business impact scenarios, equipping you to prioritize cyber risk management efforts accordingly.

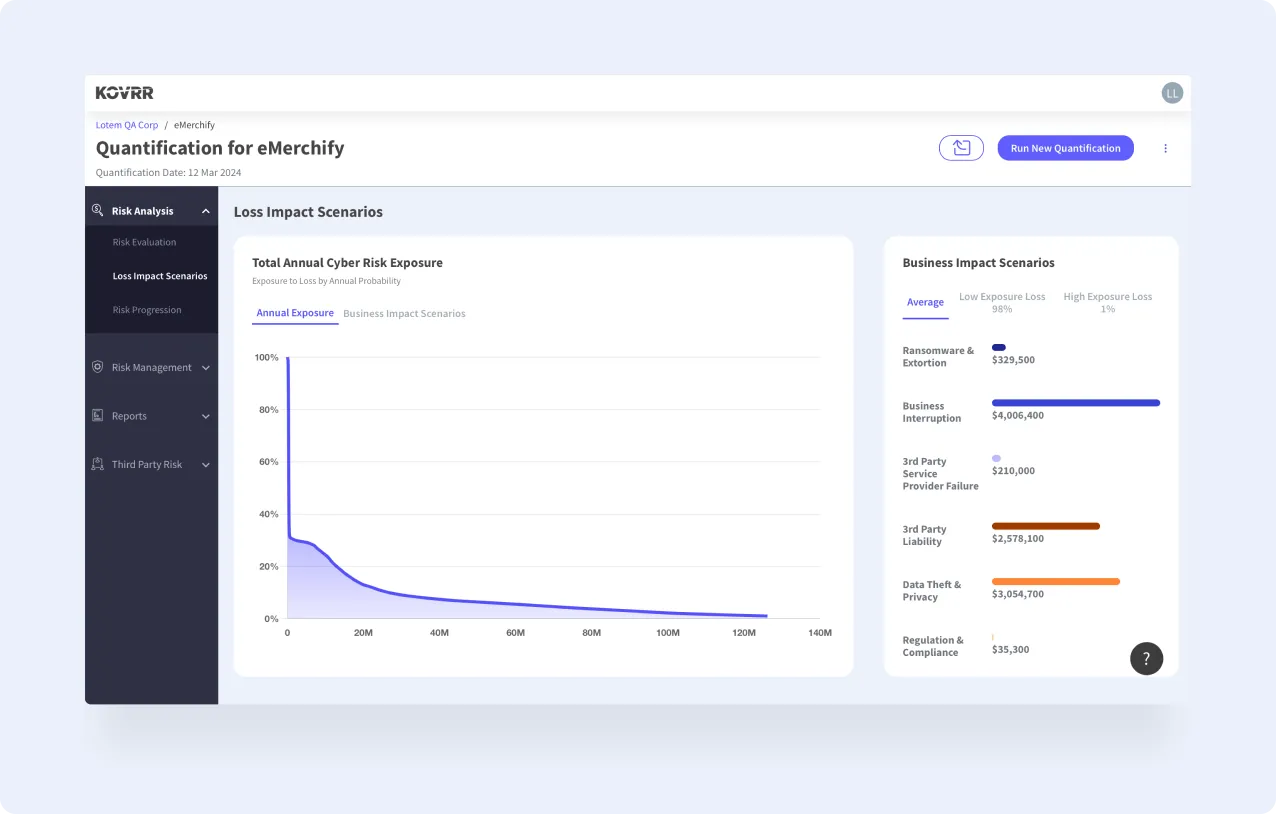

Business Loss Impact Scenarios

The costs of a cyber event are typically distributed across a number of areas. For instance, in the wake of a data breach, an organization may have to pay compliance and legal fees while also suffering from revenue loss due to compromised systems.

By breaking down these various loss impact scenarios, Kovrr’s cyber risk quantification solution offers cybersecurity leaders and financial planners crucial information, allowing for more targeted risk mitigation initiatives that minimize the likelihood and potential monetary impact of specific loss types.

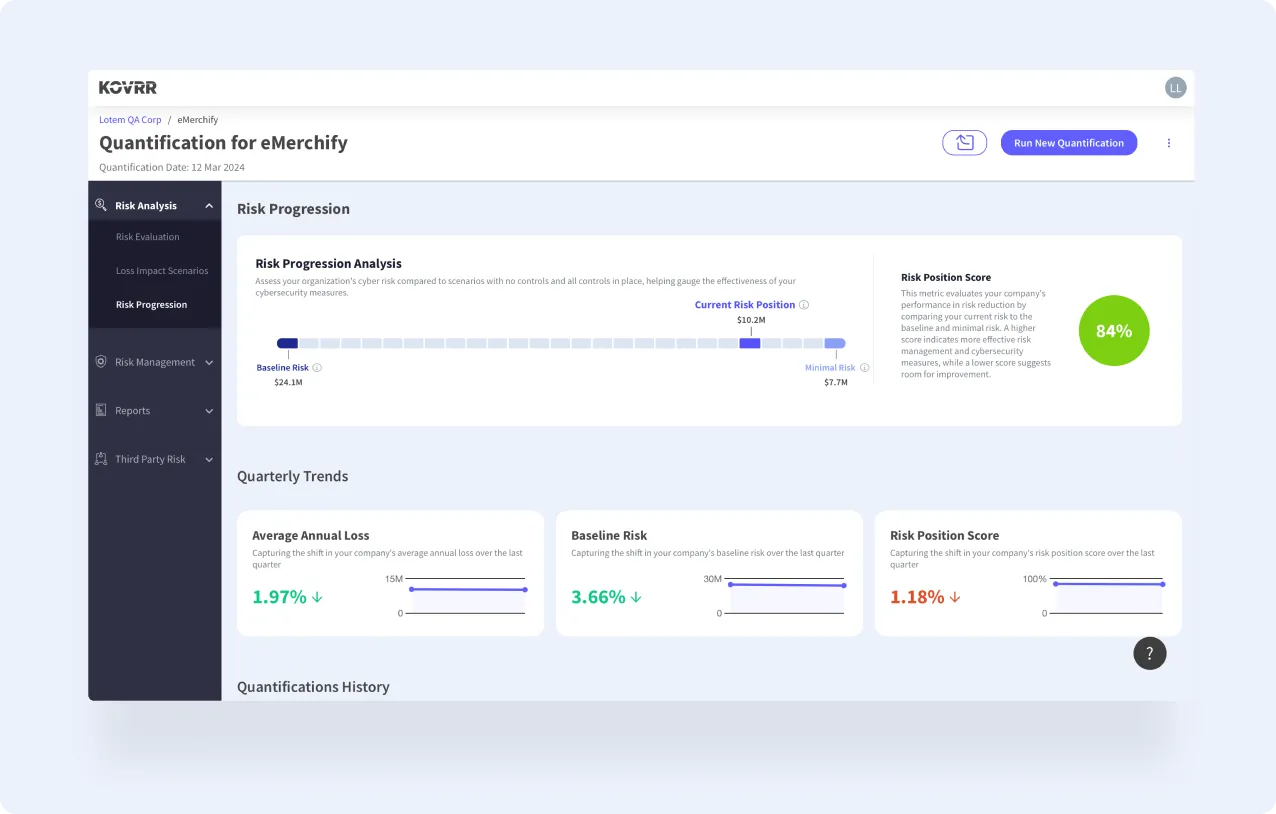

Risk Progression

Monitoring how an organization’s susceptibility to cyber risks has decreased with time and how this reduction translates into financial savings offers cybersecurity teams a more nuanced understanding of the value of their cybersecurity programs and provides essential data for more informed decision-making.

Kovrr's CRQ platform comes equipped with an easy-to-use Risk Progression feature that illuminates key metrics, enabling organizations to better understand and demonstrate how their organization's cyber risk posture has progressed based on various upgrades and structural adjustments.

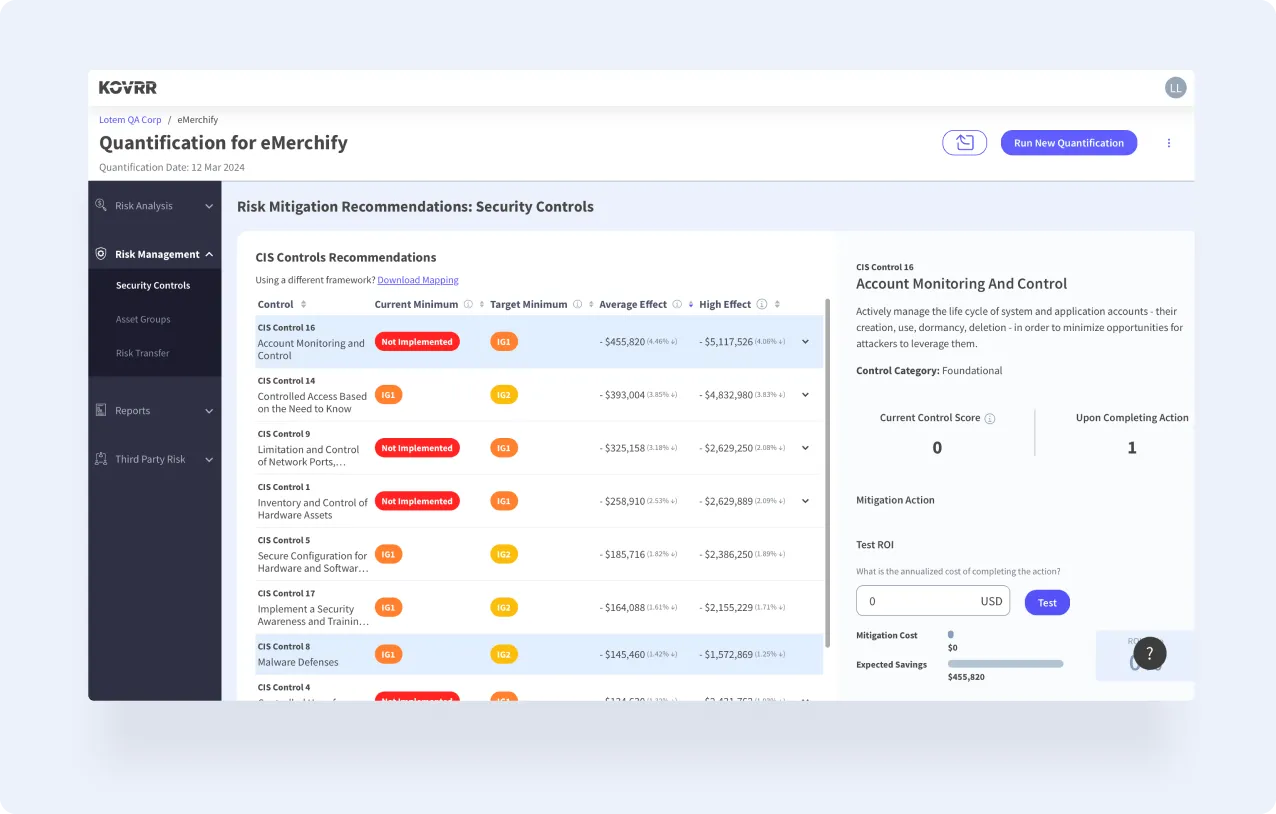

Risk Management & Security Control Upgrade Insights

Build data-driven risk mitigation strategies. Kovrr's cybersecurity recommendations enable organizations to lower their cyber risk exposure by operationalizing insights generated by our enterprise-ready models.

Cyber risk management and mitigation recommendations incorporate the most popular cybersecurity maturity frameworks (CIS, NIST, etc.), allowing Kovrr’s model to quantify the different risk profiles of an organization based on familiar security configurations. These recommendations provide the financial impact of upgrading the relative controls to higher maturity levels.

ROI Analysis for Cybersecurity Initiatives & Budget Planning

Understand the potential financial effects of different mitigation activities and compare them with their annualized cost. Kovrr’s platform has a built-in cybersecurity ROI calculator, revealing the potential savings of pursuing a specific cyber risk mitigation initiative.

Use Kovrr's CRQ platform to run what-if simulations based on programs the cybersecurity department would like to implement and quickly receive new quantification results that provide clear ROI metrics for budget planning. Leverage these quantifications to calculate multi-year ROI.

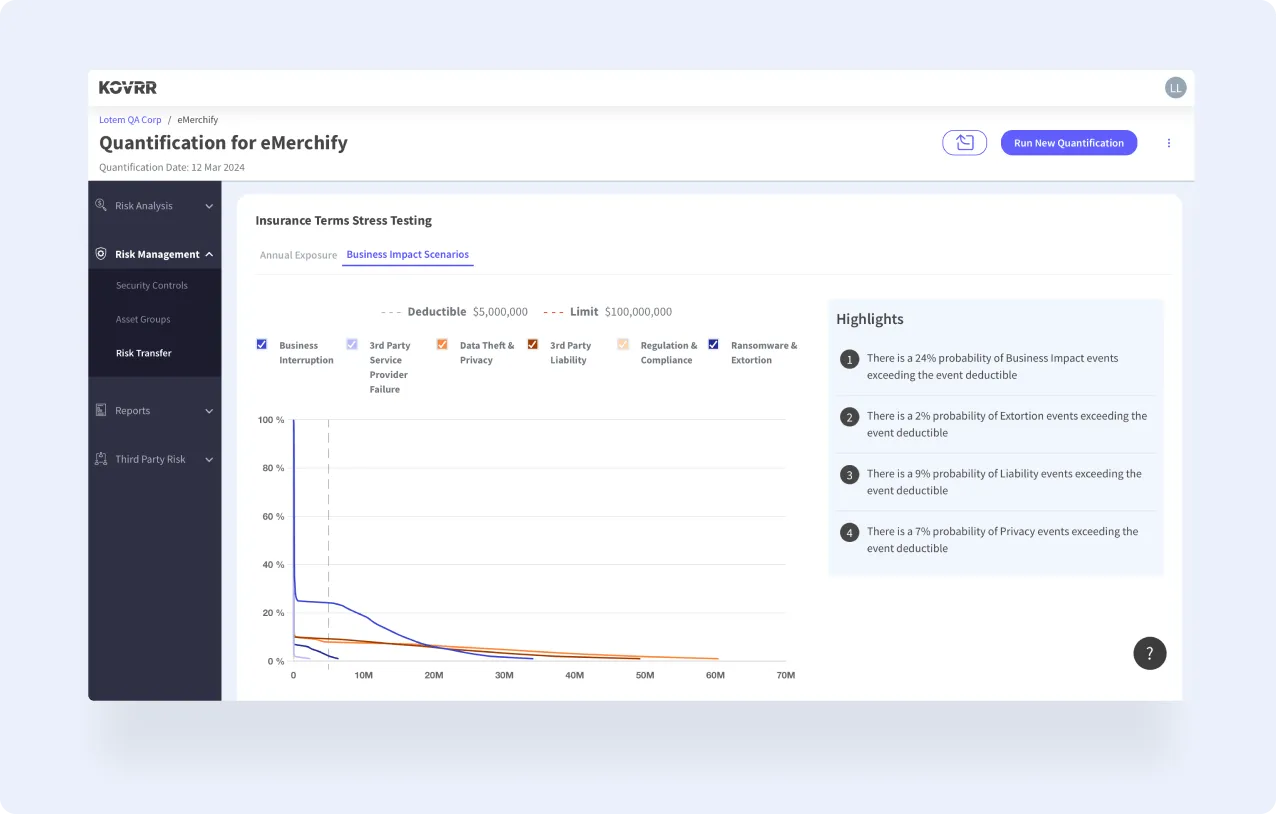

Cyber Insurance Insights

Devising cybersecurity insurance terms that meet your organization’s unique risk posture can be challenging. But with Kovrr's cyber risk quantification platform offering insights into how your policy would perform based on your current cybersecurity threat posture, your organization can negotiate an economical policy that ensures business resilience in the case of an event.

Kovrr’s CRQ solution also provides users with guidance on various insurance options according to risk appetite and policy structure and significantly aids in revealing gaps in the organization’s coverage

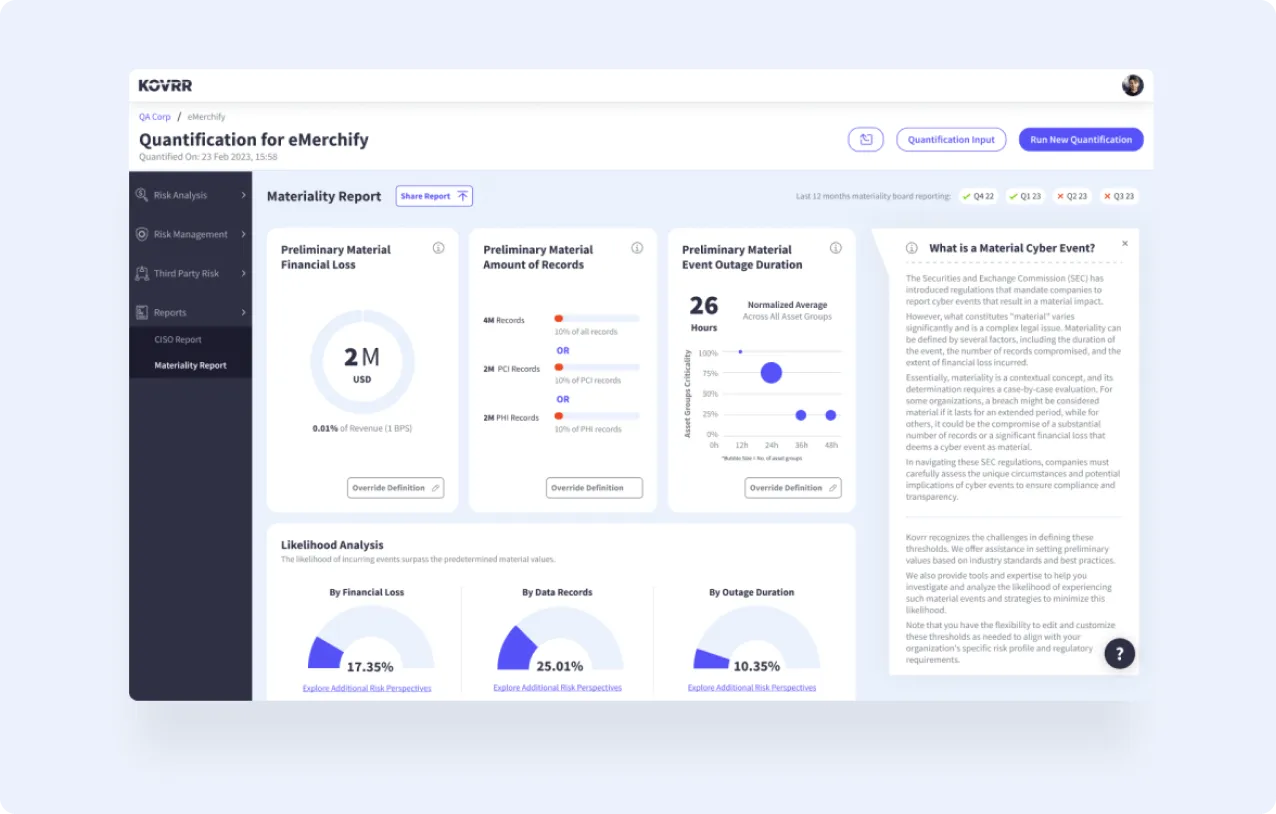

Cyber Materiality Report

As governments worldwide continue to enact legislation requiring organizations to disclose material cyber events and risks in a timely manner, it has become increasingly crucial to define this somewhat ambiguous threshold. Quantified benchmarks provide a solid starting point for this determination process.

Kovrr’s first-of-its-kind Cyber Materiality Report offers enterprises these preliminary thresholds, such as financial loss, data record compromisation, and outage time, calculated based on a customizable basis point of revenue. With these figures, disclosure is significantly streamlined, helping to ensure compliance.

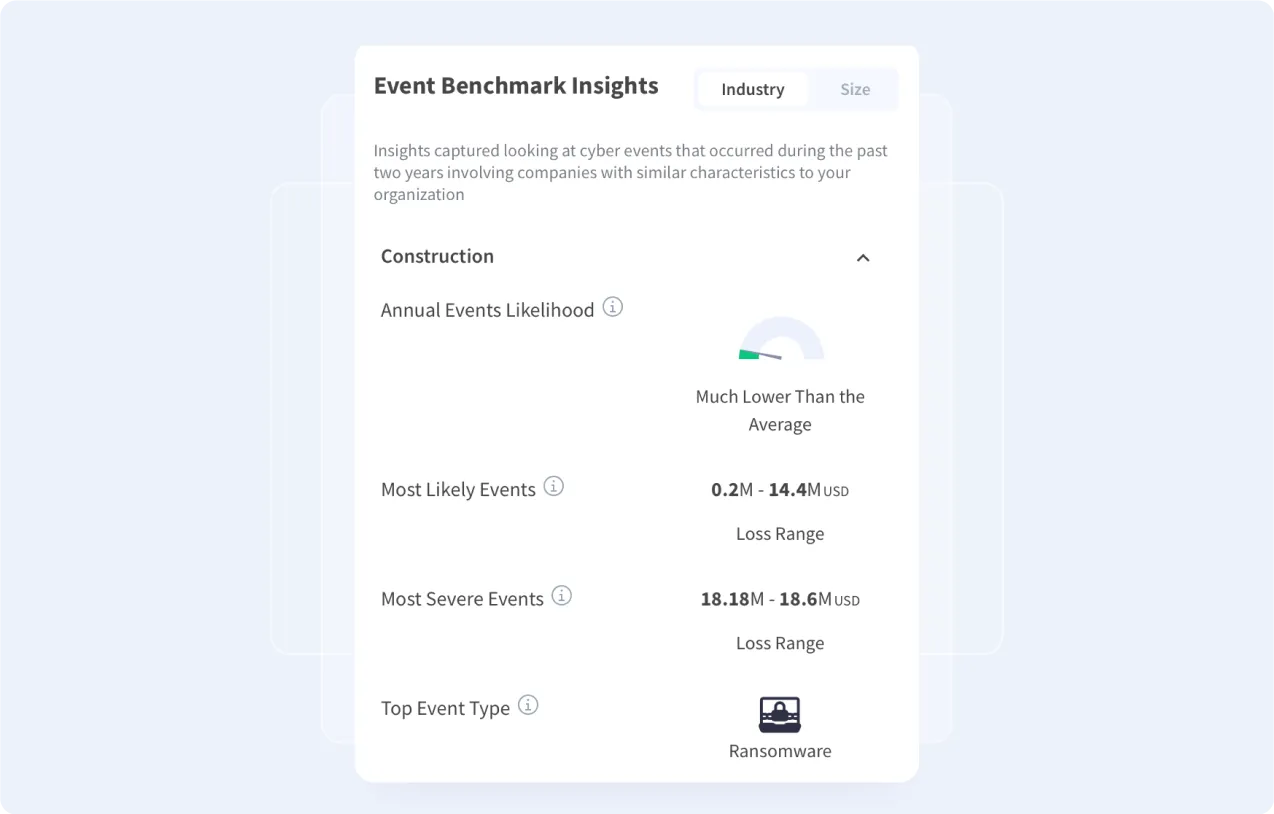

Benchmarking With Key Industry Insights

With objective insights into key peers' and players' cyber risk exposure within respective industries, organizations can ensure they’re maintaining a competitive edge and pursuing appropriate, context-specific cyber mitigation strategies.

Incorporating millions of cyber event loss data points, our CRQ solution offers critical cyber event benchmarking metrics that empower enterprise cyber risk managers to compare their risk postures and gain the necessary resources to stay ahead in the evolving cyber risk landscape.

Third-Party Cyber Risk Analysis

Uplift your TPRM & GRC program by understanding the contribution of a third-party service provider to your overall cyber risk exposure. Working with a third-party provider is an essential part of doing business, yet often, available data regarding their security controls is limited, making assessing their risk a lengthy process that renders insufficient results.

However, with Kovrr's CRQ platform, your cybersecurity team gains key insights into how third-party risk contributes to overall exposure and financial loss. The solution also provides targeted suggestions for initiatives that can limit this potential damage

Cyber-Spheres and Asset Groups

Kovrr has devised a framework that allows companies to capture the complexities of their organization and have them reflected in the cyber risk quantification results. This Cyber-Sphere methodology allows for a high level of granularity input that is then reflected in more customized cyber risk forecasts.

Users can delve deeper than an aggregated company-level cyber risk analysis by providing inputs at an Asset Group (AG) level. For example, employee endpoints can be split by country, region, or operating group, ultimately enabling more targeted risk mitigation plans.

Key Benefits

Contact us to learn moreOn-Demand Financial Cyber Risk Quantification Insights

Unlike traditional risk consulting engagements that are time and resource-consuming, Kovrr's cyber risk quantification platform provides on-demand insights, delivering a quick time-to-value. Our models leverage global threat intelligence and financial impact data from cyber incidents, empowering organizations to drill down risk according to specific cyber event components, including associated risk vectors, damage types, and other relevant impact data. Security and risk management leaders can quickly and efficiently recognize the underlying causes that impact financial exposure.

Insurance-Grade Cyber Risk Quantification Models

Our cyber risk quantification solution leverages multiple modeling technologies that differentiate between systemic attacks, targeted attacks, and failures and covers hundreds of thousands of simulated cyber events to provide the most accurate quantification metrics possible. Users can also deep dive into various business impact scenarios to understand in which loss areas cyber security risk is concentrated and the details of the scenario’s financial impact on the business.

Actionable, Objective Business-Relevant Metric

Drill down into different cyber scenarios and risk vectors to get insights into the impact of organizational cyber exposure and make more informed security investment decisions for improving programs with a cyber risk management strategy.

Comprehensive Data Acquisition and Augmentation

Reduce the need to make assumptions by integrating multiple global sources of data, including technological footprint, global threat intelligence, and cyber insurance loss intelligence. The platform boasts highly accurate data based on technology, security, and business data specific to your organization. We also include loss scenarios informed by continuously updated, wide-ranging open and proprietary data sources.

Enhanced Cyber Risk Business Impact Analysis (BIA)

Incorporate cyber preparedness into your organization’s business continuity plan (BCP) by identifying the potential financial impact of a cyber incident on your organization's critical business operations and assets. Using Kovrr's CRQ platform, cyber risk management professionals can pinpoint cyber events that can affect business activity, quantify the potential operational and financial loss, and gain sharper insights into losses per outage time. They can also can break down losses by revenue, reputation, data recovery operations, compliance with regulations, and more

Stop looking at security scores and start looking at their financial impact.

Speak with a product expert about how to quantify cyber risk,

build resilient security programs, and increase confidence within your organization.