Protect Retail Revenue by Quantifying Cyber Risk

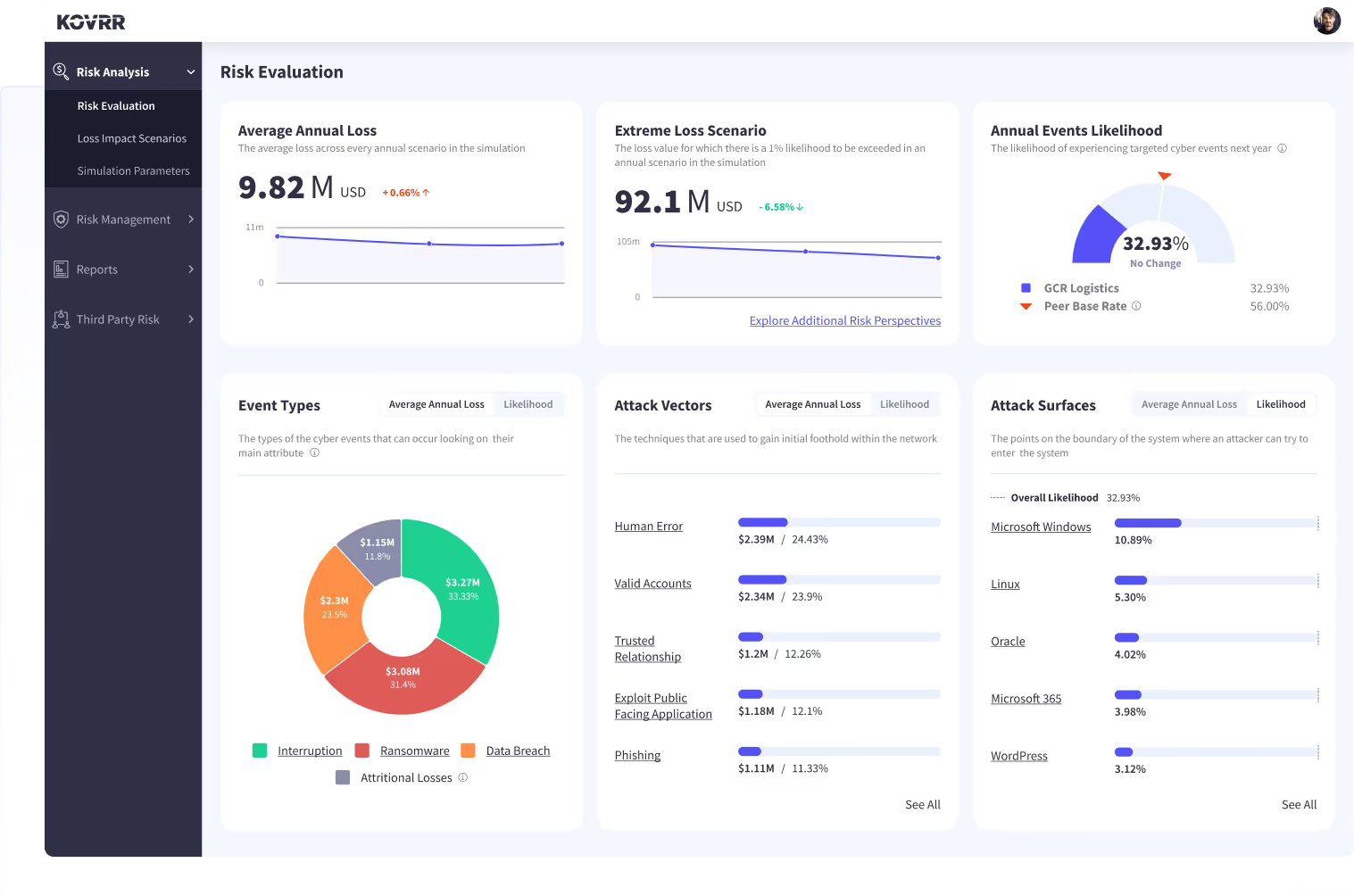

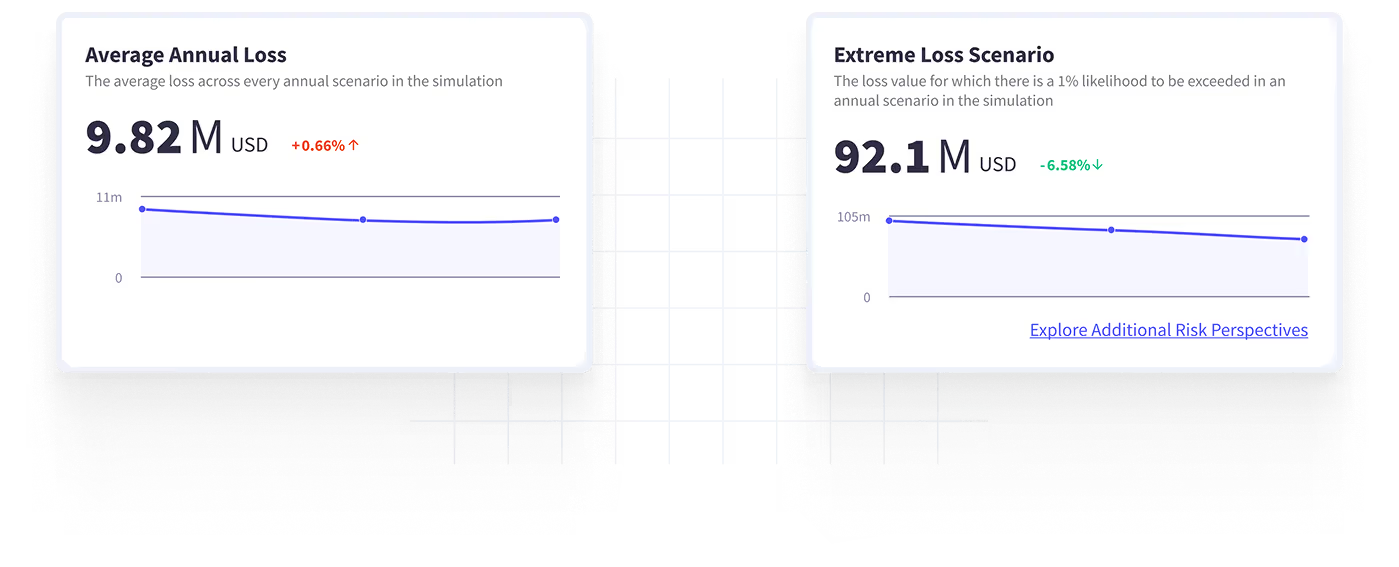

From checkout to fulfillment, retailers depend on interconnected systems that are increasingly vulnerable to costly cyber disruptions. With Kovrr, retail leaders can easily assess this cyber risk exposure in financial terms, evaluating scenarios from POS system outages to supply chain disruptions. Our CRQ platform translates these risks into clear business metrics, helping retail organizations protect revenue and strengthen consumer trust.

The Cost of Cyber Risk in the Retail World

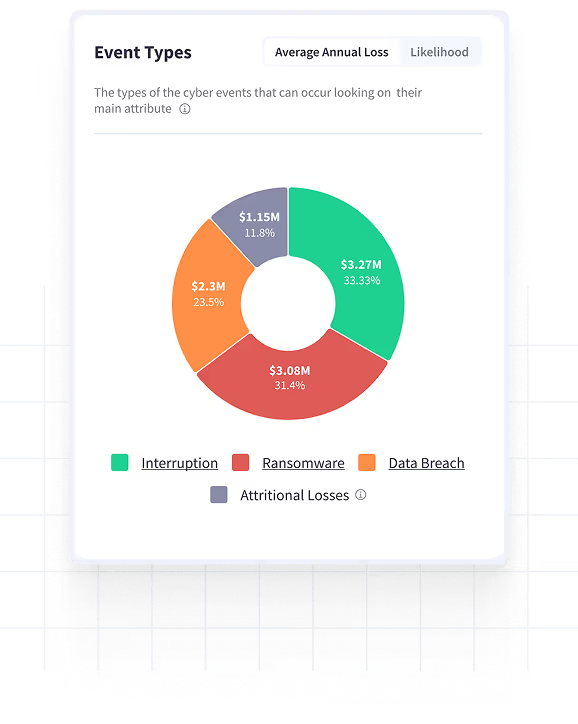

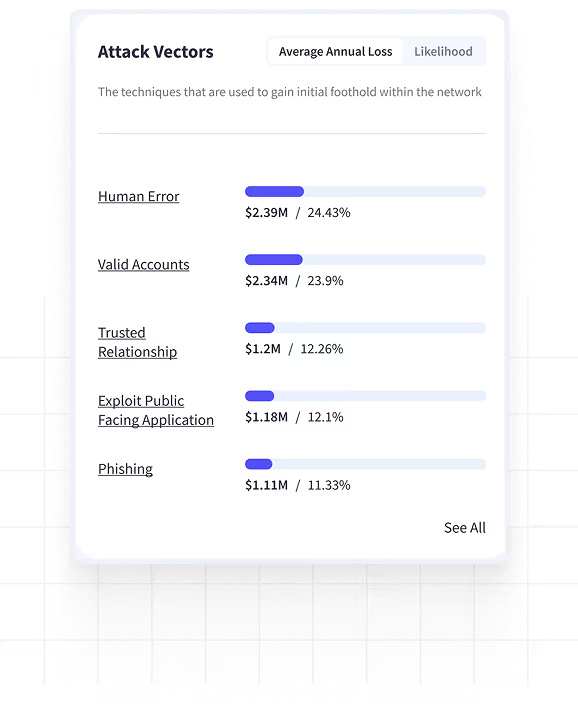

For retail businesses, even a short disruption can result in significant damage. Whether it's caused by a ransomware attack that paralyzes fulfillment centers or a breach that exposes payment data, the ensuing financial impact can be material. Unfortunately, many retailers still struggle to understand the full scope of this potential loss, relying on risk scores or compliance checklists to guide mitigation strategies and leaving key decisions disconnected from business priorities.

Bring Financial Clarity to Cyber Risk in Retail

Retailers track sales trends, foot traffic, inventory turnover and margin fluctuations with precision, all in quantified terms. However, cyber risk often lacks this same level of business insight. Kovrr's CRQ models close that gap by translating cyber exposure into clear business terms, enabling teams to examine cyber threats with the same rigor they apply to other performance drivers and allowing them to integrate it seamlessly into high-level strategic planning.

How Retailers Gain a Strategic Edge Through CRQ

With Kovrr's CRQ solution, retail organizations can:

Assess the financial impact of downtime: Understand how system outages translate into lost sales and fulfillment costs.

Prioritize the threats that matter most: Focus mitigation on risks that directly affect revenue, customer retention, and peak season performance.

Benchmark exposure across stores, systems, and vendors: Identify underperforming segments and evaluate supply chain or tech risks in dollars.

Model breach scenarios and customer trust loss: Quantify reputational fallout and legal exposure from compromised payment data or loyalty programs.

Support board and insurer alignment: Share retail-specific risk metrics that resonate with finance, compliance, and external stakeholders alike.

How a Global Retailer Used CRQ to Optimize Cyber Spend and Reduce Risk

Faced with budget constraints and competing priorities, a $3.5B retail group used Kovrr’s CRQ platform to simulate 76 project scenarios and identify the most cost-effective ways to reduce cyber risk. The result: 12 high-impact initiatives with up to 165% ROI and full stakeholder buy-in from the CFO and CIO.

Cyber Risk Management for Retail FAQs

Schedule a DemoCan Kovrr’s CRQ help me model scenarios specific to the retail industry?

Yes. Kovrr's CRQ platform can simulate custom-defined high-impact retail-specific scenarios, such as supply chain disruptions, POS system outages, and ransomware attacks during peak season. The solution also models the lower-impact scenarios that might be worth exploring and mitigating, depending on risk appetite. These insights help retailers understand financial exposure and build strategies that protect the bottom line.

What kind of internal or external data is needed to run CRQ for a retail business?

Kovrr's CRQ model ingests a wide range of cyber risk intelligence and threat data, along with company-specific inputs like a retail organization's business unit infrastructure, security control profile, and revenue and data record segmentation. Retailers can further enrich this model with integrations and can specify regional operational differences to generate more accurate exposure metrics.

Is the platform scalable for retail chains of different sizes and locations?

Yes. Regardless of whether a retailer operates a few localized storefronts or manages a global retail network, Kovrr's CRQ can easily adapt to the organizational structure. Our proprietary modeling methodology ensures stakeholders can capture this unique characteristic. The platform also supports portfolio analysis, regional-specific breakdown, and any other business unit granularity, making it ideal for mid-size and enterprise-level retailers alike.

How often should a retail organization update its CRQ analysis?

Most cyber risk management teams in the retail sector benefit most from quarterly CRQ runs, especially when they're conducted before budgeting cycles or peak season. However, subsequent runs can also be made after organizational restructuring or control upgrades or to check for the latest emerging threats. Kovrr's CRQ capabilities make it easy to refresh scenarios and maintain continuous cyber risk visibility.